atc income tax india

Section 80C of Income Tax Act is applicable only for individual taxpayers and. Medical allowance is paid every month and it depends on which designation you are.

Income-tax Return Forms for Assessment Year 2022-23.

. It states that qualifying investments up to a maximum of Rs. CBDT extends last date for. Tax on the income earned which is payable to the Government of India at the end of each financial year is known as Income Tax.

1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. On the next slab those earning between Rs600000 and Rs12 million a year the tax is 5 on. Atc Income Tax India.

Individuals can claim an additional tax deduction of 50000 available to both salaried and self-employed individuals for contribution towards NPS. You can try to find more information on their website. Atc Income Tax India.

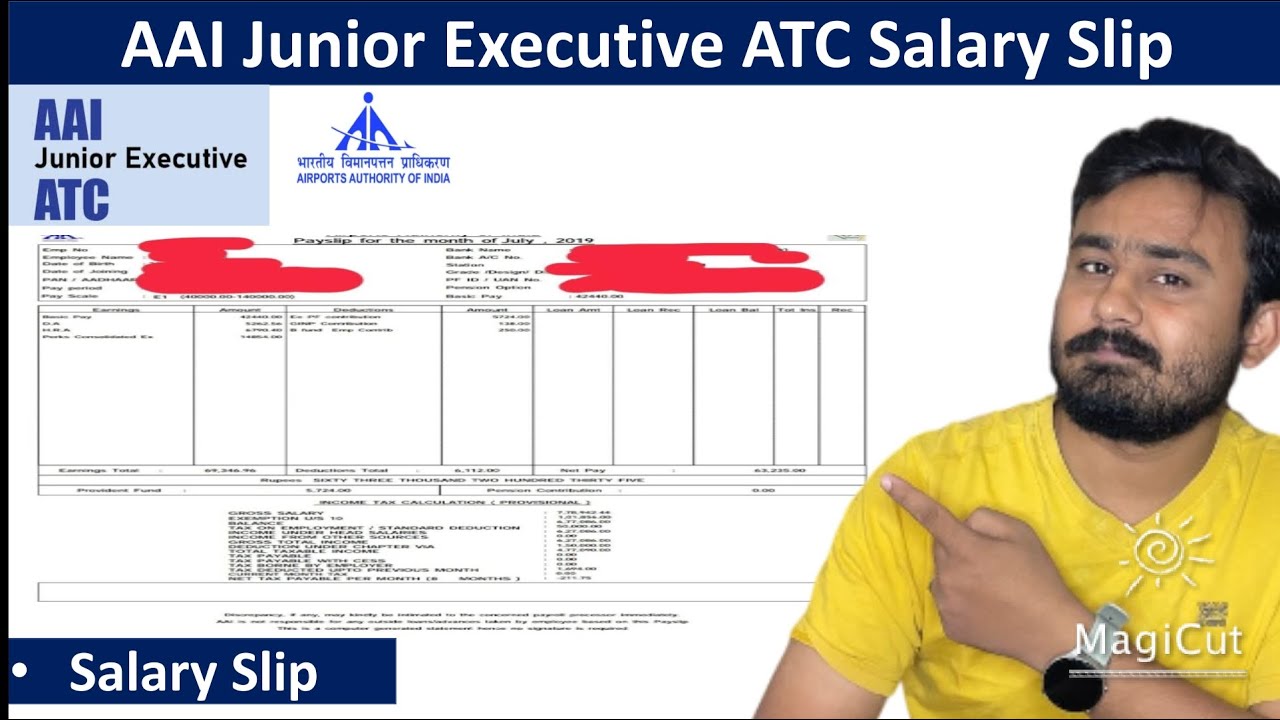

For JE-ATC this can be approximately INR 8000 Income tax will be depending on how much. India Monthly Tax Calculator with 2022 Income Tax Slabs Use the Monthly Tax Calculator to. Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax.

Perks is yet to be decided. Corporate Action Department Exchange Plaza 5th floor Plot No. 150 Lakh are deductible from your income.

JE ATC is entitled to INR 3000 per month. Section 80 of the Income Tax Act Section 80C Us 80C you are able to reduce Rs150000 from your taxable income. Certain activities not to constitute business connection in India.

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax. A maximum of Rs150000 can be asserted for. Tax Rates DTAA v.

This income tax exemption is allowed to HUF members as well as non-HUF members. 150 Lakh and you end up paying no tax on it at all. All the employees of the Airports Authority of India are paid with consolidated perks which are fixed at 35 of the basic pay.

Income-tax Return Forms for Assessment Year 2022-23. Self Contribution Under Section 80CCD 1B. Indian Public School Near Karakambaadi Tirupati-Kadapa High Way Tirupati Andhra Pradesh 517501 India Prashanth English Medium High School 20-2-506A2 TMC Road Near Sri Chaithaya School Maruthi Nagar Korlagunta Tirupati Andhra Pradesh 517501 India.

So in the case of JE-ATC it stands out to be INR 14000. Employee Contribution Under Section 80CCD 1. The average salary of a JE ATC can be approximated to INR 65000 approx.

21 This Act may be called the Income-tax Act. 21 This Act may be called the Income-tax Act. Income Tax Gratuity Social Security Schemes and Pension do remember all AAI employees get Pension after retirement.

What is the phone number of ATC Income Tax Office. A resident company is taxed on its worldwide income. 12500 whichever is less.

Section 80C of the Income Tax Act is the section that deals with these tax breaks. Income-tax Second Amendment Act 1998 11 of 1999 Finance Act 1999 27 of 1999 Income-tax Amendment Act 1999 28 of 1999. A resident company is.

Reported anonymously by ATC Income Tax employees. It allows for a maximum deduction of up to Rs15 lakh every year from an investors total taxable income. KUMAR CO Puttur Andhra Pradesh 517583 India Coordinate.

ATC Income Tax benefits and perks including insurance benefits retirement benefits and vacation policy. Insertion of rule 16DD and form 56FF to the Income-tax Rules 1962. Section - 115C Definitions Section - 115AC Tax on income from bonds or Global Depository Receipts purchased in foreign currency or capital gains arising from their transfer Section - 115ACA Tax on income from Global Depository Receipts purchased in foreign currency or capital gains arising from their transfer Section - 57 Deductions Section - 115A.

The limit is capped at 15 lakh aggregate of 80C 80CCC and 80CCD. Tax deductions under Section 80CCD are. INCOME-TAX ACT 1961 43 OF 1961 AS AMENDED BY FINANCE ACT 2008 An Act to consolidate and amend the law relating to income-tax and super-tax BE it enacted by Parliament in the Twelfth Year of the Republic of India as follows CHAPTER I PRELIMINARY Short title extent and commencement.

Atc Income Tax India. 15 lakh per financial year under Section 80C of the Income Tax Act and its allied sections such as 80CCC and 80CCD. 3 reviews of ATC Income Tax These star ratings should be a lot higher the service providers here are friendly fast and start forward.

All tax returns are backed by our Triple-A Promise. Income Tax Specialist Certification Course Rs 848 Month Henry Harvin In Online C1 G Block Bandra Kurla Complex Bandra East Mumbai 400 051. This rating has been stable over the past 12 months.

Income on receipt of capital asset or stock in trade by specified person from specified entity. Fax 2659823738 66418126 2524 SCRIP CODE. Find your nearest ATC Income Tax offices and make an.

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax. Incomes not included in total income. This means that your income gets reduced by this investment amount up to Rs.

What S The Salary Of An Air Traffic Controller Quora

Income Tax Benefits For Senior Citizens 2019 इनकम ट क स म म लन व ल फ यद Youtube

Income Tax Specialist Certification Course Rs 848 Month Henry Harvin In Mumbai

Bjp Got 80 Of Corporate Donations Among Five National Parties In 2018 19 Adr

What Will Be The In Hand Salary Per Month Of An Aai Junior Executive Quora

Aai Junior Executive Salary Slip Aai Junior Executive Perks Allowance Sarkari Naukri Vale Baba Youtube

How To File Itr 1 For Ay 2019 20 With Detailed Form 16 In Hindi Youtube

Manish Mishra Atc Application Engineer Alstom Formally Signalling Solutions Limited Linkedin

Gst India Tax Taxation Vat Excise Servicetax Indirecttax Economy Business Finance Law Corpor Indirect Tax Goods And Service Tax Goods And Services

What The Sc S Dismissal Of Telcos Pleas On Adjusted Gross Revenue Means For Them India Today Insight News

All About Filling Of Eform Aoc 4 Income Tax Return Indirect Tax Income Tax

What Is Atc Certificate In Gem Atc Certificate क य ह और क स बन ग How To Make Atc In Gem Youtube

What Will Be The In Hand Salary Per Month Of An Aai Junior Executive Quora